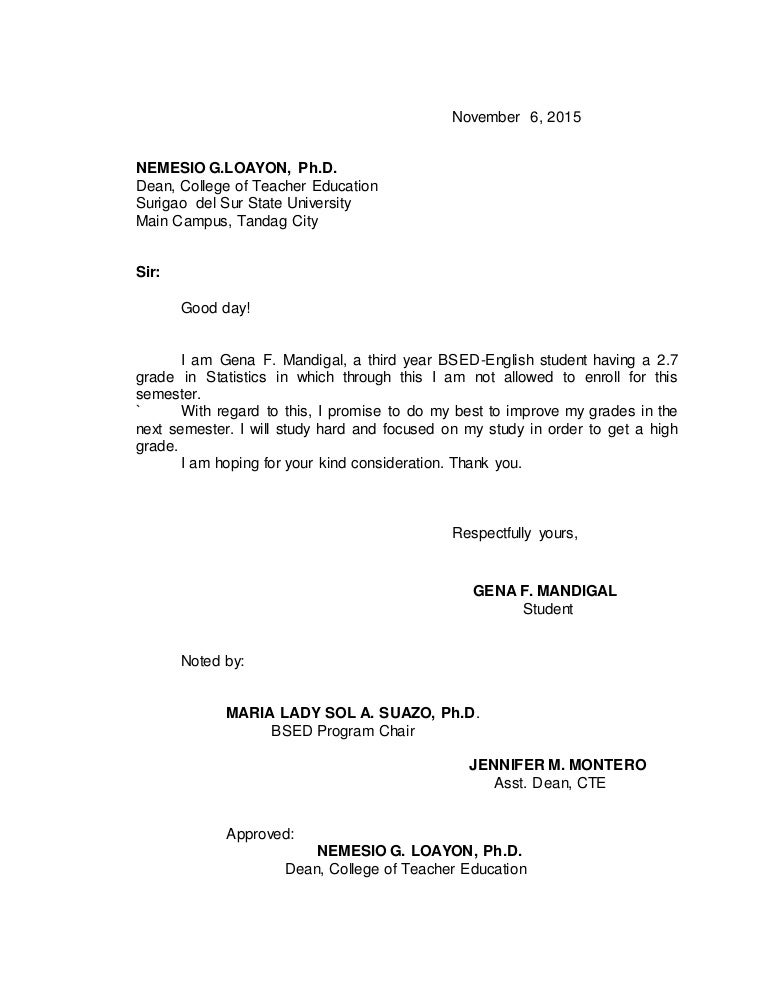

Indeed, you’ve not actually put in a proper mortgage software but really

- Standard guess

- Fast-requires only ten full minutes

- Monetary info is Not verified

- Borrowing is not looked

- Vow to help you give, at the mercy of family research

- A lot more for the-depth-requires at the least a couple of days

- Financial info is affirmed

- Borrowing are checked

Before you go to acquire a special family, perhaps one of the most extremely important factors for you, your own agent and you may manufacturers is when much household you are able to afford. If you choose to loans the home with a mortgage, you ought to discover from a loan provider the amount of money you could use. You’ll also need certainly to determine what percentage number are comfy to you inside your complete monthly funds. Simply because you might acquire a specific amount doesn’t invariably indicate you need to purchase anywhere near this much.

Pre-Degree

If you decide to wade the house loan route and require a fast, general idea of one’s expenses stamina, bringing home financing pre-degree is an excellent initial step. Becoming pre-qualified setting you’ve advised your own financial basic information about your own assets and you may earnings and they’ve got go back with an offer out of exactly how far household you can afford. One to imagine is not guaranteed because of the financial as they very have in all probability maybe not viewed proof of your bank account or drawn their credit thus far. Consider pre-degree since the an amount borrowed you can be eligible for For many who pertain. The advantage of pre-qualification is actually price. You can aquire pre-accredited over the phone in as little as ten full minutes. Yet not, if you wish to carry out a significant impression to the a home agents and suppliers, you will have to rating pre-acknowledged.

Pre-Acceptance

Are pre-approved to own borrowing for home financing form you have taken the process past pre-degree. You have recorded a software through home financing Banker who’s got removed your credit rating, and you will you’ve because of the lender any required papers to have financial pre-approval questioned loan places Natural Bridge of the bank away from income, property and work. With a good pre-approval to possess credit, a keen underwriter keeps reviewed the mortgage file and you may approved a written vow to help you give, susceptible to summary of an appraisal for the domestic in question or any other conditions oriented when you get a hold of your home.

Regarding a bona fide house agent’s angle, pre-approval provides you with a leg upon other, less-waiting customers. Pre-recognized homeowners is also work quicker once they find a house they want because they currently have its investment really at your fingertips. Indeed, of a lot realtors will manage pre-recognized homeowners while they learn their budget confidently. it reveals providers that the customers is a critical client.

What to anticipate

Pre-certification often is much faster than simply pre-recognition as the lender does not be sure every piece of information you really have considering. Having a great pre-qualification, loan providers usually normally ask for your very own contact information, an offer of one’s credit history, a standard thought of domestic price and you will what kind of household you are interested in (priily family, an such like.). Loan providers would want to pinpoint your debt-to-income ratio (the newest percentage of your own gross month-to-month earnings you to visits using from your overall loans) as well as your prospective financing-to-well worth ratio, otherwise LTV (the fresh new portion of the property value the property youre looking to buy one to stands for your house loan amount). Even be ready to inform your lender on one advance payment you’re likely to make. Credit are not looked, so don’t worry on a beneficial pre-degree inside your credit history.

To have a beneficial pre-acceptance, the lending company tend to receive your credit history and ask your to possess first financial data such taxation statements, shell out stubs, W-2s, lender statements, an such like. It is a call at-breadth studies of one’s cash, so assume it for taking a few days or even more. The extra date may be worth it in the long run given the clout pre-approvals provides.